Article - What Happens without Project Portfolio Management and Proper Resourcing?

Submitted by Jamal Moustafaev on Sat, 04/11/2015 - 13:04

There is a multitude of potential problems that await the company without proper project portfolio management processes in place. Initially lack of portfolio management manifests in terms of reluctance to kill weak project proposals, project being selected based on politics or emotions and lack of strategic criteria in the project selection.

What are the immediate results of such ad-hoc approach? There are at least two: too many projects are added to the pipeline and many – if not the majority – of these ventures are of low-value to the organization.

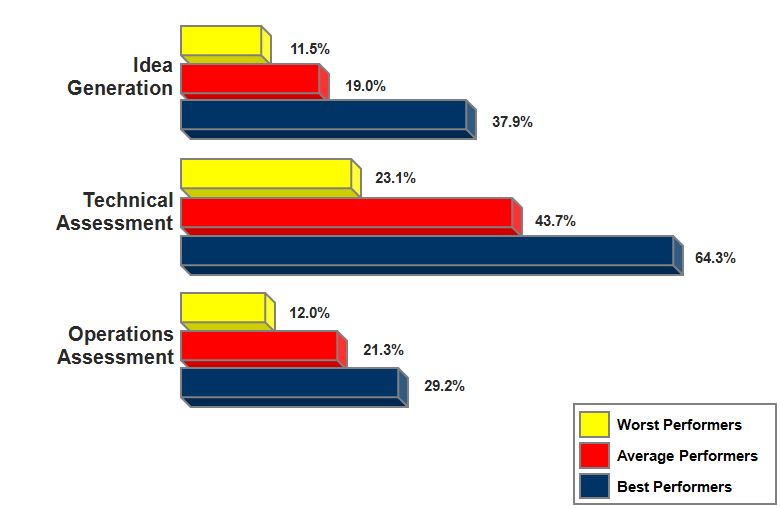

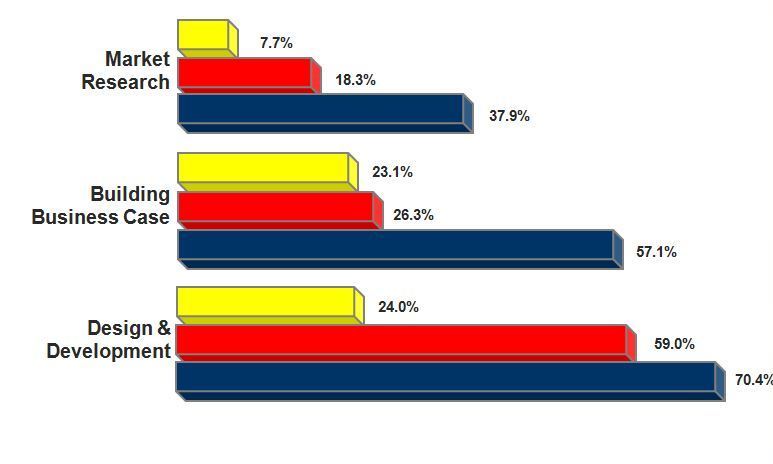

These two aspects also have several long-term effects. Because the company resources are too thinly spread across multiple initiatives, delivery times tend to increase and the final quality of the products tends to suffer, because the employees are scrambling between multiple ventures, missing deadlines and making mistakes that are harder and harder to fix as the projects progress from initiation to the close-out stages.

The project failure rates increase either because the initial ideas were of poor value or because – even if they were indeed good ideas – the project teams fail to deliver quality products. As a result, the proverbial “product winners” that every executive craves to see in his company offerings are very hard to come by.

If one can use the sniper analogy, instead of placing few well-aimed shots from a high-quality rifle, the company fires multiple blasts from the shotgun hoping that some of the pellets fired will hit the targets.

Another interesting phenomenon that I have observed at multiple organizations is the accumulation of the technical debt that eventually eclipses all of the high-value project work the company can deliver instead.

Let me demonstrate this by a real-life example (see Figure 1). I once worked at an IT department of a large financial institution. The executive management of the department had a very interesting approach to their strategic planning; at the beginning of every year they would examine the previous year’s performance statistics and discover that the information technology group has delivered, say, fifty projects. They would go the strategic planning meeting of the entire company and claim something to the effect of: