Case Study - Project Portfolio Model - R&D Department of a Product Company

Submitted by Jamal Moustafaev on Wed, 09/09/2015 - 14:38Introduction

In my professional engagements I very frequently get to develop project portfolio management models together with the executives from various companies. Today I wanted to share yet another very interesting case study with my readers: the company we are going to examine is a very successful bearings manufacturer. As a matter of fact for a number of years they have focused all of their research and development efforts solely on the bearings production.

However, under a considerable pressure from their sales team, the executives of the company has at one point of time decided to review their strategy. The sales department has been for several years insisting that when they talk to their customers, they keep asking questions about other bearing-related products such as sealants, lubricants and electronic components which the company has not been producing at the time.

Strategy

As a result of the above-mentioned events the company management came up with the new strategy for the R&D department that consisted of the following initiatives:

- Develop new (i.e. lubricants, sealants and electronic components) product families

- Develop attractive products (i.e. something that is really demanded by our customers)

- Increase revenues and profitability by developing new product families

- Increase market share in the new markets

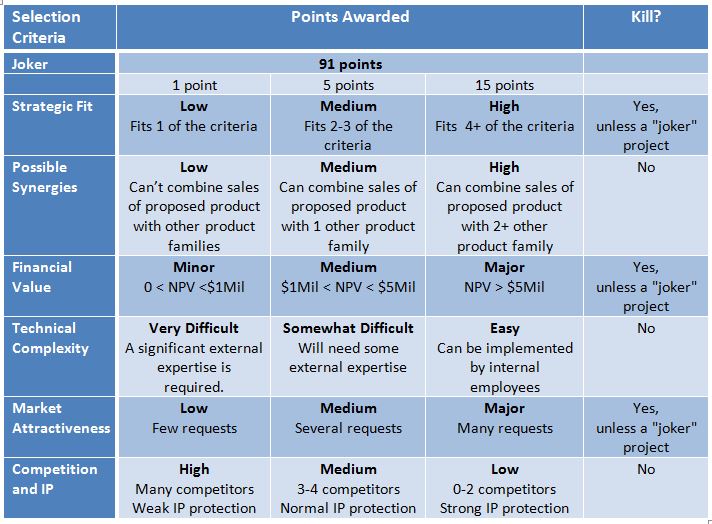

The Scoring Model

The scoring model developed by the executives included the following variables (see Table 1):

- Strategic fit

- Possible synergies

- Financial value

- Payback

- Technical complexity (skills in-house)

- Market attractiveness

- Competition and IP

Table 1