Introduction

The energy company to be analyzed in this section of the chapter is an Eastern European electrical company that has until recently enjoyed a full monopoly, selling the electricity at one fixed rate irrelevant of whether it was dealing with private residences, small, medium or large businesses or government agencies. However the recent legislation by the country's government allowed for the deregulation of the electricity market. This implied that any energy company from the three or four neighbouring countries would be able to enter the market and compete with the former monopolist when it came to selling electricity to both private residences and businesses.

In addition the company management felt that the value of the projects they have been delivering so far was too low. Also, the executives mentioned that they seemed to have too many initiatives on the go while utterly lacking the resources (primarily human) to deliver all of them on-time and on-budget.

Strategy

The company strategy has been well-defined before the project portfolio workshop and, considering the recent deregulation, consisted of the following elements:

- Need to design attractive products. This implies:

- Various size of electricity packages

- Fixed and variable rate packages to suit different customer needs

- Extend loans to the customers needing them, especially the start-up businesses

- Create different packages for households and businesses

- Increase revenues and profitability

- Improve public relations damaged by the years of monopolistic presence in the market

- Social responsibility - initiate more green programs

The Scoring Model

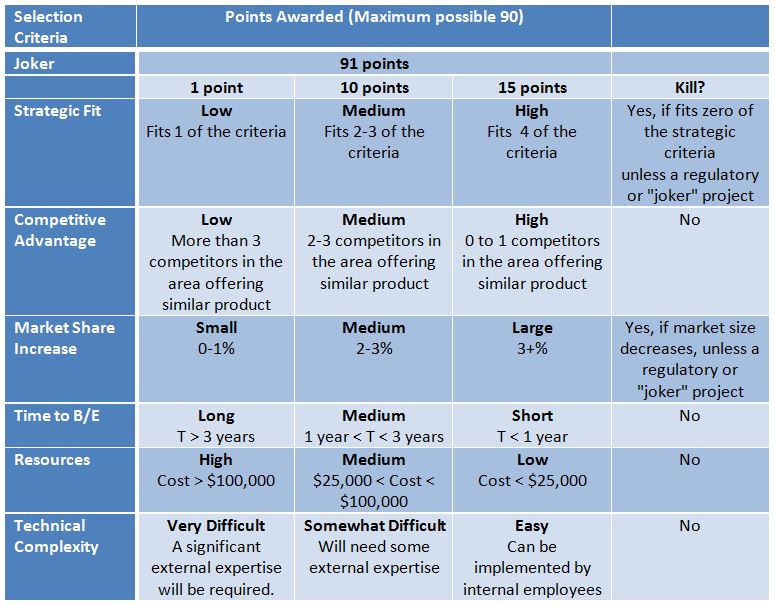

The scoring model developed during the facilitated portfolio management session contained the following variables (see Table 1):

- Strategic Fit

- Competitive Advantage

- Market Share Increase

- Time to break-even

- Resources

- Technical Complexity

Table 1

The project proposal would receive one point if it fit only one of the fours strategies, five points if it covered between two and three strategic initiatives and fifteen points if it absorbed all four of the strategies. This category has been designated as a "kill" for the projects that were not deemed regulatory or "joker" ones.

The second variable included in the model was the competitive advantage. The management decided to distribute the points in the following manner:

- More than 3 competitors in the area offering similar product - 1 point

- 2-3 competitors in the area offering similar product - 5 points

- 0 to 1 competitors in the area offering similar product - 15 points

The third variable added was the potential impact of the project on the market share increase (decrease), since the company was expecting a potential drop in the control of the market share due to the new deregulation laws. If the project was expected to grow the market share by between 0 and 1%, it would be awarded 1 point, if it was expected to grow the share by 2-3% - 5 points, and finally, if it was expected to increase the market share by more than 3% - 15 points. This category has also been marked as a "kill" variable, meaning the projects expected to diminish the company's market share would be automatically removed from further consideration unless they were regulatory or "joker" projects.

Time to break-even was the fourth variable added to the model with points being distributed in the following manner:

- T > 3 years - 1 point

- 1 year < T < 3 years - 5 points

- T < 1 year - 15 points

The fifth component was the resource requirements needed for the project. In the opinion of the executives it served a dual role. First it directly tied to the "grow revenues and profits" strategy, and second, it allowed the company to shift away from larger, more complex endeavors towards smaller "quick wins".

As a result, projects costing more than $100,000 would receive one point, those with their budgets in between $25,000 and $100,000 - a score of five points, and the ones with the budget of less than $25,000 - fifteen points.

Finally the executives of the company decided to add the "technical complexity" variable to the mix in order to penalize the complex initiatives requiring an involvement of many external resources. The points have been allocated according to the following scheme:

- A significant external expertise will be required - 1 point

- Will need some external expertise - 5 points

- Can be implemented by internal employees - 15 points

Therefore in the model created during the portfolio management session the maximum number of points a project could get was 90, while the minimum was 6 points. If the project was of a regulatory nature or law-mandated one it would get an automatic score of 91 points, thus taking it to the very top of the prioritization list. Same procedure would apply to "joker" projects approved by teh portfolio steering committee.

For more information on how to develop project scoring models, please read my articles "How to Prioritize Projects? – Part 1" and"How to Prioritize Projects? – Part 2".

Portfolio Balance

The senior management of the company decided to monitor the portfolio balance by using the following bubble chart model (see also Figure 1):

- Risk vs. Time to Break-Even

For a detailed discussion of the portfolio balance, please check out my article "Jamal's Musings - What is Portfolio Balance?"

Strategic Alignment

The company decided to use an unusual two-pronged approach for the strategic alignment. The larger, strategic flagship projects - most likely the "jokers" - would be allocated via the Top-Down approach, while all the rest of the initiatives would undergo a Top-Down, Bottom-Up procedure.

The buckets designated for the Top-Down, Bottom-Up process were:

- Maintenance

- Improvements to the existing products and services

- New products

For more information about project portfolio alignment, please see my article "What is Portfolio Strategic Alignment and Why Should Your CEO Worry About It?"

About the Author

Jamal Moustafaev, MBA, PMP – president and founder of Thinktank Consulting is an internationally acclaimed expert and speaker in the areas of project/portfolio management, scope definition, process improvement and corporate training. Jamal Moustafaev has done work for private-sector companies and government organizations in Canada, US, Asia, Europe and Middle East. Read Jamal’s Blog @ www.thinktankconsulting.ca

- Please follow me on Twitter:

- Like our page on Facebook:

- Connect with me on LinkedIn:

- Subscribe to my RSS feed:

Jamal is an author of two very popular books: Delivering Exceptional Project Results: A Practical Guide to Project Selection, Scoping, Estimation and Management and Project Scope Management: A Practical Guide to Requirements for Engineering, Product, Construction, IT and Enterprise Projects.